A group that represents small and medium-sized businesses in P.E.I. and elsewhere across the country is calling on the federal government to offset its two-month tax holiday with support for owners.

The Canadian Federation of Independent Business wants Ottawa to provide those businesses with $1,000 in compensation to help them cope with the cost of the sales tax break from Dec. 14, 2024, to Feb. 15, 2025.

It’s also asking for a commitment that business owners won’t face penalties from the Canada Revenue Agency if they make errors in applying the reductions.

Frederic Gionet, the CFIB’s senior policy analyst for the Atlantic region, said businesses in P.E.I were surprised by the federal government’s GST/HST holiday proposal, especially since it comes so close to the Christmas shopping season.

“The complexity of implementing these kinds of changes at the last minute before the Christmas season is catching a lot of small businesses off-guard,” Gionet told Island Morning‘s Laura Chapin on Friday.

“A lot of people will be waiting until Dec. 14 to make their purchases. Even worse, some of them may return previously purchased products in order to take advantage of the rebate.”

On Thursday, the House of Commons passed legislation that will remove the federal sales tax for two months from a range of items, including children’s toys, books, restaurant meals and takeout, as well as beer and wine.

In provinces where the federal goods and services tax (GST) is blended with provincial sales taxes to form the HST or harmonized sales tax, the province portion will also disappear for the two months covered.

The bill, which the Liberals and NDP agreed to fast-track through the usual procedural steps, now goes to the Senate.

When asked about the impact his recently announced affordability measures could have on provincial budgets, Prime Minister Justin Trudeau said he expects his provincial counterparts to recognize the financial challenges Canadians are experiencing.

Gionet said Friday that 62 per cent of small and medium-sized businesses oppose the tax holiday, saying it will require them to change their point-of-sale systems and retag eligible items, then change everything back when the tax comes into effect again after Feb. 15.

Since the list of eligible items is quite long, he said owners are worried about making mistakes and getting trouble with the Canada Revenue Agency.

“They believe that the cost… and the risk they’re incurring may just not be worth it. They’re quite suspicious about it,” Gionet said.

“Something more permanent would be a lot better so the investment into changing all these things would be worthwhile, more than just two months and then having to revert to the original setup.”

Yes, it’ll require some [businesses] to adjust their systems to take off the taxes, but I also know Canadians are excited about getting out there and benefiting from this.— Prime Minister Justin Trudeau

Speaking to Island Morning host Mitch Cormier on Friday, Prime Minister Justin Trudeau did not commit to compensating business owners or exempting them from penalties.

“So many families are turning to prepared foods, so many families are turning to things that aren’t GST-exempt, particularly around the holidays. This goes to everyone and everyone needs this break, and that’s why it’s going to make a huge difference for the next two months,” Trudeau said.

“Yes, it’ll require some [businesses] to adjust their systems to take off the taxes, but I also know Canadians are excited about getting out there and benefiting from this come mid-December.”

Prince Edward Islanders will soon benefit from a two-month break from HST on some products, as well as on restaurant meals. P.E.I. Premier Dennis King says his government got no notice of the federally announced change, which will hit the province’s bottom line hard. But he acknowledges that Canadians struggling with the cost of living could use a break.

Trudeau’s Liberals originally pitched the tax holiday along with a plan to send $250 cheques to the 18.7 million people in Canada who worked in 2023 and earned $150,000 or less. But some Canadians raised concerns about being excluded from the millions who would receive those cheques.

The NDP threatened to withhold support for the entire package if the government didn’t split the promises into two pieces of legislation. The Liberals did not include the cheques measure in the bill the House of Commons passed Thursday night.

It is unclear when they might present that legislation.

Trudeau said Friday he’s “working hard for it” and hoping for NDP support to present that legislation soon.

Province participating willingly

P.E.I. is one of five provinces with a harmonized sales tax, and Premier Dennis King has said the tax pause could cost the province roughly $14 million due to the loss of the provincial portion.

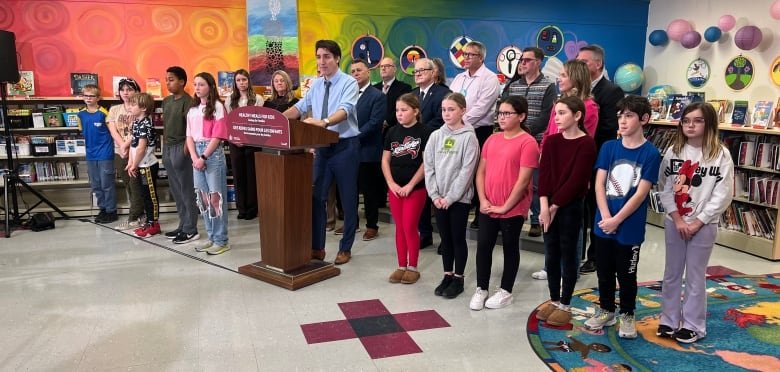

King and the prime minister, who was in P.E.I. Friday to announce funding for the province’s school food program, met to talk about that shortfall.

During a news conference with Trudeau, the premier said the province is willingly participating in the tax holiday, but he didn’t get a firm commitment on whether the federal government would help make up the loss to P.E.I.’s coffers.

“I did put the prime minister and [Cardigan MP Lawrence] MacAulay on notice that, not unlike the past, the government of Prince Edward Island may have a project or two we want to put forward that may receive some special attention along the way,” King said.

“They didn’t give me any guarantees on that, but knowing our history, we have done very well.”

The federal government estimates the tax holiday will cost the federal treasury an estimated $1.6 billion in foregone revenue. As it’s currently designed, the $250 cheque program would cost about $4.68 billion, a Finance Department official told CBC News.